Explanation of Financial Settings

Understand all of Allmoxy's financial capabilities and controls:

To customize Financial Settings, click on the ⚙️ ➡️ Financial

Receiving Payments:

In this section, you will have the option to select your Merchant Gateway. This is a mandatory step in your instance setup. We recommend using Stripe. If you do not have a Merchant Gateway set up, your customers cannot make payments online.

Financial Management:

This section is where you will set Defaults for any new customer; these include:

- Currency

- Checkout Flow (when you want the customer to pay).

- Bounced Check Fees

- Interest Accrual Methods

- Interest Accrual Threshold

- Finance Charge Interest Rate

- Status to Export Sales Order

- Status to Charge Customers

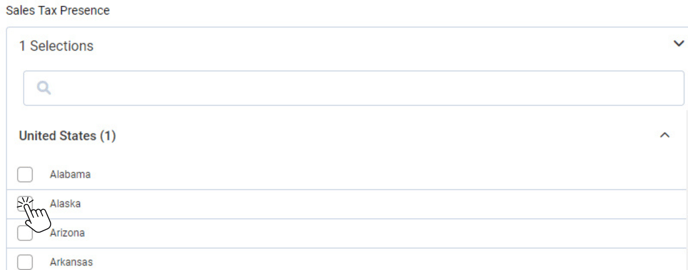

- Sales Tax Presence

- Your Allmoxy instance will automatically select your business's state of residence as taxable. You can add additional states where you need to collect sales tax by checking the box next to each state.

- Your Allmoxy instance will automatically select your business's state of residence as taxable. You can add additional states where you need to collect sales tax by checking the box next to each state.

Job Costing:

This section is for you to calculate your overhead per order in reports. You will select the default markup percentage. Then you will need to enter your average monthly labor hours. This will need to be completed for the system to allocate overhead costs.

Payroll:

- Pay Period - Length of pay periods; Weekly, Bi-Weekly, Semi-Monthly, Monthly

- Start Day - The day of the week your pay period begins.

- Payroll Tax - This value will reflect the Social Security and Medicare (FICA) and State and Federal Unemployment Taxes (SUTA and FUTA) you pay on top of the employees' hourly wages. (See both state and federal instructions to implement these taxes)