Understand the Finance Charge settings inside of Allmoxy to ensure a smooth collections process for you and your customers.

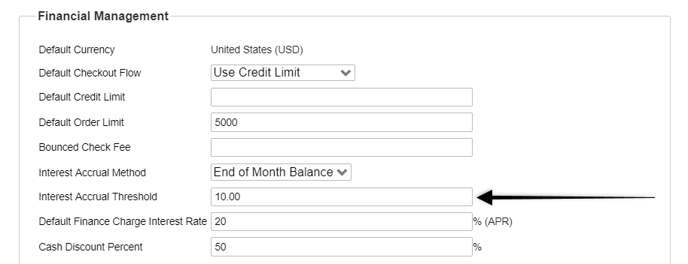

Default Finance Charge Interest Rate:

The Default Finance Charge Interest Rate is APR (annual percentage rate), not MPR. So, you’ll divide the percentage by twelve before calculating the finance charge on an outstanding balance.

For example, if your finance charge interest rate is 13%, you'll divide that by 12 (1.08333%) and then multiply it by your total.

If you're total is $25.76, the monthly finance charge would be (25.76 * 1.08333%) $2.14

Accrual Method:

Allmoxy provides two methods for accruing the finance charge: daily balance or end of month balance.

The daily balance method logs the open balance daily and at the end of the month adds up all interest charges that happened that month.

The end of month method simply looks at the balance on the last minute of a month, multiplies it by the monthly finance charge rate and creates an invoice.

Interest Accrual Threshold:

You can also set a Finance Charges Invoice threshold so that you're not generating invoices for minuscule dollar amounts. For example, you can set the threshold for $10.00, then a finance charge invoice won't be created until the charge exceeds the $10 threshold. This charge will accrue in the background but not publish a Finance Charge invoice until the threshold has been met.

Use a trigger to automatically email finance charge invoices when they're created in Allmoxy!