Tax Exemption & Custom Tax Rates

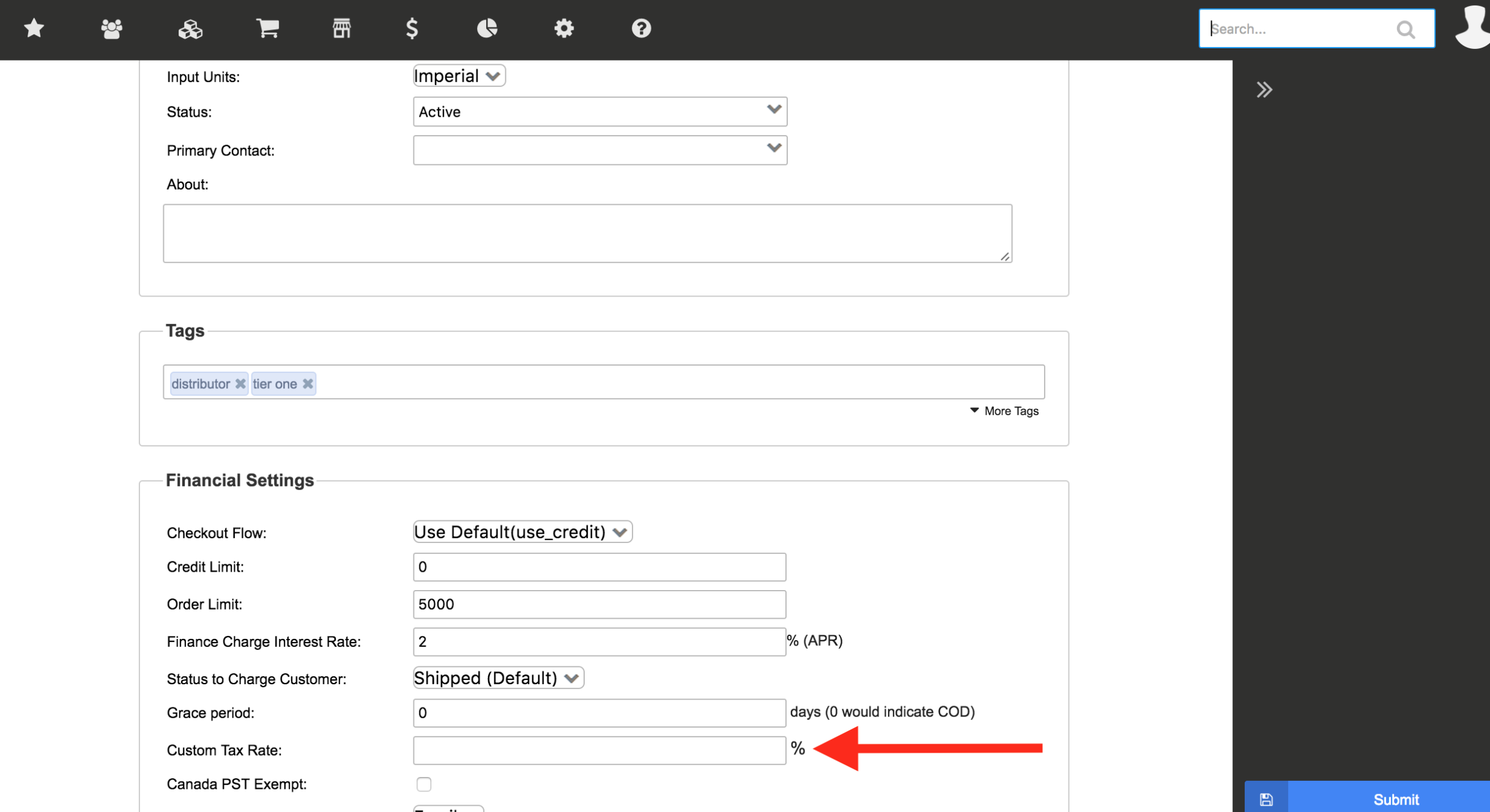

If you need to override a customer's tax rate, go to the company for which you want to remove or change the tax rate and click "info" near their company name:

Find the field named "Custom Tax Rate" and input the rate you'd like them to have. If your customer is tax exempt, this rate would be 0. If they have a unique tax situation, enter their custom rate.

Allmoxy uses TaxJar sales tax calculations. These are real-time rates with precision rooftop-to-rooftop accuracy. If you find an erroneous tax rate, contact your customer success manager before hardcoding a custom tax rate.

Tax exempt customers are required to provide proof of their tax exemption. This exemption status typically comes with a tax-exempt ID. We recommend creating a Custom Field to keep track of these exemption IDs in Allmoxy, but you can also simply add this information in a note on the company level or attach a copy of the exemption to their company!

If you are not charging tax in Allmoxy (we don't recommend this), you will need to set every customer's custom tax rate to 0.